Zoetis (ZTS) Q4 Earnings: Key Insights Before the Report

Zoetis Earnings Preview: What Investors Need to Know

Animal health company Zoetis (NYSE:ZTS) is set to release its quarterly earnings report this Thursday morning. As investors and analysts prepare for the announcement, there are several key factors to consider that could influence the stock’s performance in the coming days.

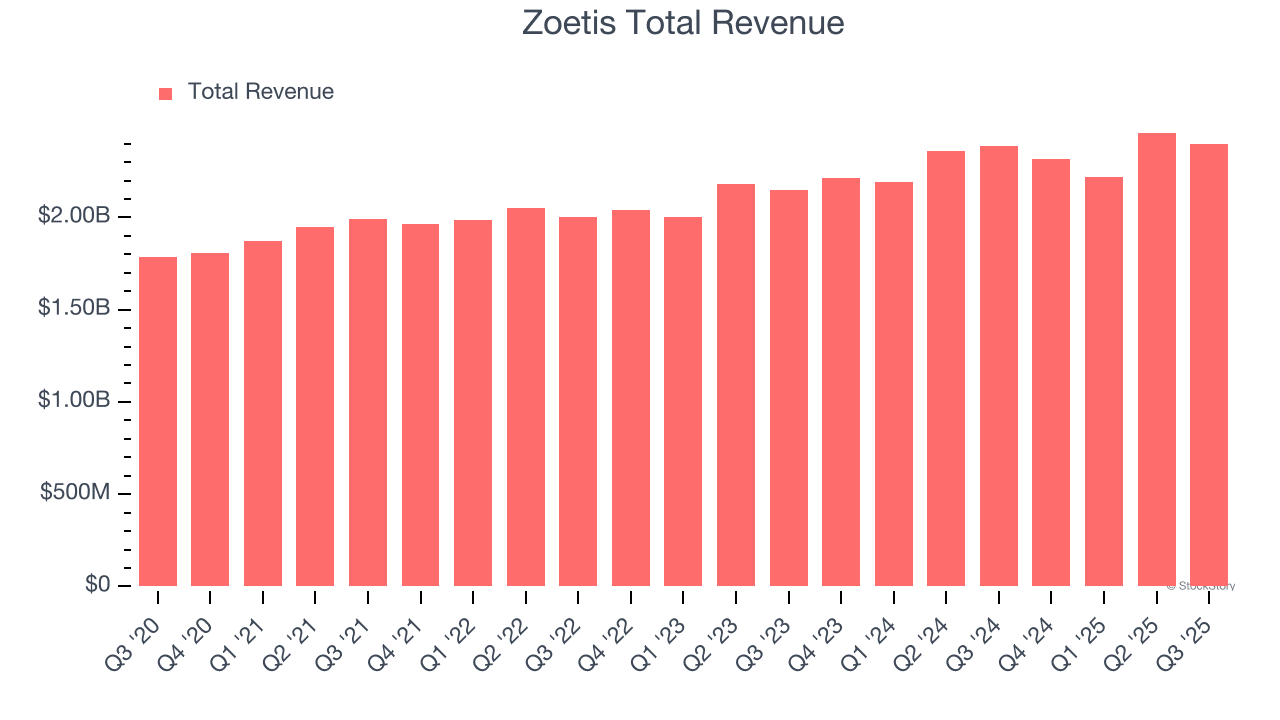

Last quarter, Zoetis met analysts’ revenue expectations, reporting $2.4 billion in sales, which remained flat compared to the previous year. The results were mixed overall, with the company beating EPS estimates but slightly missing full-year revenue guidance. This performance highlights the challenges the company faces as it navigates a competitive and evolving market.

Looking ahead, analysts expect Zoetis’s revenue to grow by 2.2% year on year to $2.37 billion this quarter, a slower pace than the 4.7% increase recorded in the same period last year. Adjusted earnings are expected to come in at $1.40 per share, reflecting a cautious outlook for the near term.

Analysts Remain Confident in Zoetis’s Performance

Over the past 30 days, analysts covering Zoetis have largely reaffirmed their financial estimates, indicating they believe the company will continue to perform consistently leading up to the earnings report. In fact, Zoetis has only missed Wall Street’s revenue expectations once in the last two years, often exceeding top-line projections by an average of 1.5%.

This level of consistency is rare in today’s volatile market, especially within the pharmaceutical sector. When compared to its peers in the branded pharmaceuticals segment, Zoetis appears to be holding its own. Several of these companies have already released their Q4 results, offering some insight into what might be ahead.

For example, Eli Lilly reported a significant year-on-year revenue growth of 42.6%, surpassing analyst expectations by 7.4%. Bristol-Myers Squibb also performed well, with revenues rising 1.4% and beating estimates by 4.8%. Both stocks saw positive gains following their reports, with Eli Lilly up 1.7% and Bristol-Myers Squibb climbing 7.6%.

Market Conditions and Outlook for 2025

Despite these positive signs from some of Zoetis’s competitors, the broader pharmaceutical sector faces uncertainty. The outlook for 2025 remains unclear due to potential changes in trade policy and ongoing discussions about corporate tax reforms. These factors could impact business confidence and long-term growth prospects.

In this challenging environment, many branded pharmaceuticals stocks have shown resilience, but the group as a whole has underperformed. On average, share prices have declined by 3.7% over the last month. Zoetis, however, has held up better, with a 2.2% gain during the same period. The stock currently trades at $128.53, while the average analyst price target stands at $152.81.

Investor Considerations

As Zoetis prepares to announce its latest results, investors should closely monitor the company’s performance relative to expectations. While the stock has shown steady growth, the broader market conditions and regulatory uncertainties could create headwinds.

For those interested in deeper analysis, there are resources available that provide insights into the company’s financials and strategic direction. These analyses can help investors make informed decisions about whether to buy, hold, or sell Zoetis shares in the wake of the earnings report.

Final Thoughts

Zoetis is entering its earnings season with a mix of cautious optimism and market challenges. The company’s consistent performance and strong analyst support suggest it is well-positioned to weather current uncertainties. However, external factors such as trade policies and tax discussions could play a critical role in shaping its future trajectory. Investors will be watching closely to see how the company performs against expectations and what this means for its long-term value.

- IDCloudHost dan Edelweiss Healthcare Kembangkan Infrastruktur AI untuk Sistem Kesehatan - February 18, 2026

- Zoetis (ZTS) Q4 Earnings: Key Insights Before the Report - February 18, 2026

- Samuel Lee’s Unbelievable Past Before Single’s Inferno Season 5 - February 18, 2026

Leave a Reply