A nuclear startup aims to revitalize the sluggish industry

A nuclear-power startup has announced a breakthrough that could address two major challenges in the industry: the high cost and lengthy time required to construct new reactors. Alva Energy, a company named after Thomas Alva Edison, claims it can add 10 gigawatts of nuclear energy to the U.S. power grid—equivalent to nine or 10 large reactors—in the near future by increasing the output of existing nuclear plants.

The startup has received backing from notable figures in the tech and investment sectors. Pat Gelsinger, former CEO of Intel, is now a general partner at Playground Global, which led Alva’s recent $33 million fundraising round. Other investors include Segra Capital Management, the Carlyle Group’s NGP Energy, Joe Lonsdale’s 8VC, and nuclear-power influencer Isabelle Boemeke. Gelsinger has joined Alva’s board and emphasized the company’s potential to meet the growing electricity demands of artificial-intelligence data centers without the usual financial and timeline constraints of new projects.

“We have no economic capacity as a nation going forward unless we dramatically upgrade our energy capacity,” Gelsinger said in an interview. The AI boom has significantly increased electricity demand, creating bottlenecks in connecting new projects to the grid. It has also sparked interest in nuclear power among tech companies, leading to a “bring your own power” movement where companies are building their own power generation facilities.

Big tech companies have signed agreements to support the restart of nuclear reactors in Pennsylvania and Iowa, covering the costs of relicensing, upgrades, and maintenance at other plants. In some cases, they have invested directly in small modular reactor (SMR) developers or become anchor customers for early projects. President Trump has set a goal to quadruple nuclear-power generation by 2050.

Squeezing more electricity out of existing plants is known as an uprate. A 2024 Energy Department report highlighted uprates as a low-hanging fruit for the power industry. Alva’s co-founder James Krellenstein estimates that each of his uprate projects would cost just over $1 billion, take five years or less, and add between 200 and 300 megawatts of generating capacity to the grid.

In comparison, building a large reactor in the U.S. that generates about 1,100 megawatts of power is estimated to cost roughly $10 billion. The last two reactors at Georgia’s Plant Vogtle cost more than $30 billion and took over a decade to complete.

“We hope that power uprates are the gateway drug for the financial community to learn how to do project financing for new builds as well,” Krellenstein said.

There are two types of commercial reactors in the U.S.: boiling-water reactors and pressurized-water reactors. While boiling-water reactors have already seen significant power uprates, many of the more than three dozen pressurized-water reactors still have untapped potential. Krellenstein said Alva will target those reactors, where the main challenges have been costs and the downtime needed for retrofitting decades-old, bespoke steam-turbine generator plants.

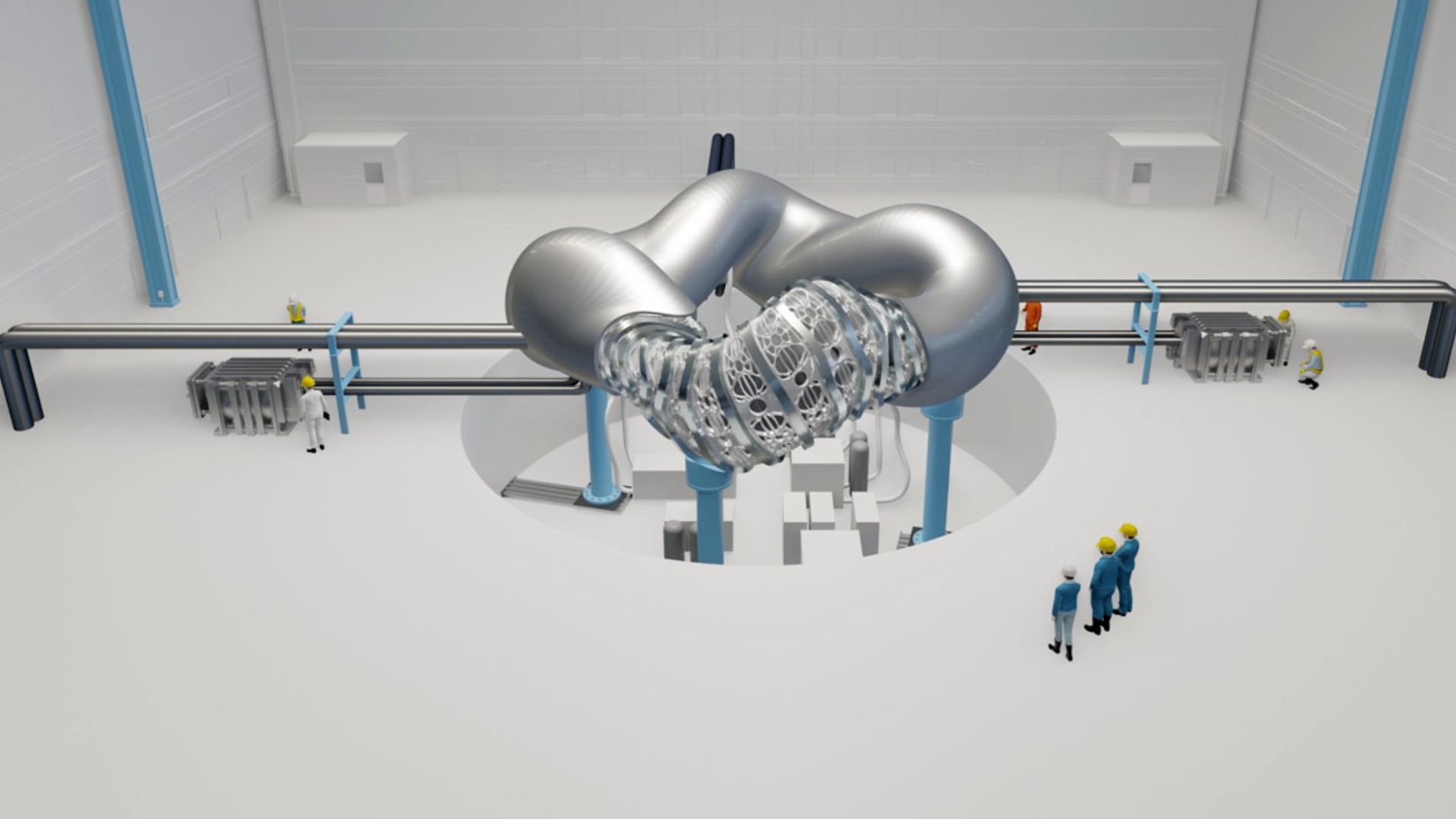

Alva’s uprate projects would work as follows: The company would act as the project developer for building a steam-turbine and electric generator next to existing nuclear facilities, allowing the plant to continue producing power during construction. During a refueling outage—scheduled every 18 months to two years—Alva would replace the steam generators inside the nuclear-containment dome.

The reactor system would then produce 20% to 30% more steam, with the excess steam directed to the new turbine-generator plant. Alva’s digital-control system would coordinate the reactor, the original turbine, and the new unit.

Jacopo Buongiorno, a nuclear-science and engineering professor at MIT, noted that building a second steam turbine while the plant continues normal operations would be a crucial time-saver. “The down time could be pretty short. It could be on the order of a few weeks instead of many months,” he said, depending on what else needs to be replaced in the plant.

U.S. nuclear plants have already achieved about 8 gigawatts of power uprates in the past three decades, Buongiorno said. “The difference now is that AI data centers provide a customer willing to pay a premium for that speed,” he added.

Many nuclear-power plants have fewer reactors than initially planned due to rising costs and waning enthusiasm after the Three Mile Island incident in the late 1970s. This means the transmission infrastructure often has excess capacity. “They’ve already built so much capacity at the sites,” Gelsinger said. “They have the land. They have the power-grid connections. So, it really just comes down to harvesting value that was established decades earlier.”

Alva is counting on tech companies to purchase the new power. These companies face pressure to prove they are adding generation to the grid rather than drawing from existing supplies. While they prefer clean energy, their growing electricity needs are also driving the development of more natural-gas power plants.

Arthur Hyde, partner and portfolio manager at Segra Capital Management, said uprates could solve the problem of adding large amounts of clean power and could happen on a similar timeline as new gas projects. “Not 5 or 10 megawatts, but 200 or 300 megawatts per project within a five- or six-year time frame,” Hyde said, adding that the costs could be lower than those of natural-gas plants.

- Apa Yang Harus Dilakukan Jika Tetangga Menanam Tanaman Invasif Di Sekitar Properti Anda - March 10, 2026

- Awal Ramadan, PLN UIP3B Sulawesi dan Unhas Tandatangani MoU Pengembangan SDM dan Inovasi Ketenagalistrikan - March 10, 2026

- Riset Nusantara Centre: Jamu, Budaya Besar, Ekonomi Kecil - March 9, 2026

Leave a Reply