STIM stock surges 41% after hours: What’s the buzz?

Neuronetics Inc. Shares Surge Following Strong Fourth-Quarter Results

Neuronetics Inc. (STIM) experienced a significant surge in its stock price, rising 41.08% to $2.06 in after-hours trading on Tuesday. This sharp increase followed the release of preliminary fourth-quarter 2025 financial results, which highlighted strong performance across multiple business segments.

Revenue Growth Across Both Segments

The medical technology company reported fourth-quarter 2025 revenue of $41.8 million, marking a 23% increase on an adjusted pro forma basis and an impressive 86% rise compared to the same period in 2024 on an as-reported basis. This growth was driven by both the NeuroStar system and clinic revenue.

Revenue from the NeuroStar system, the first transcranial magnetic stimulation (TMS) device to receive clearance from the Food and Drug Administration (FDA), reached $18.3 million, representing a 9% increase on a pro forma basis. Clinic revenue also saw a notable rise, reaching $23.5 million, up 37% on a pro forma basis.

During the quarter, the company shipped 49 NeuroStar Advanced Therapy systems and generated positive operating cash flow of $0.9 million, aligning with previously issued guidance. This performance underscores the company’s ability to maintain operational efficiency while expanding its market presence.

Full-Year Performance Demonstrates Sustained Growth

Looking at the full year of 2025, Neuronetics reported total revenue of $149.2 million, reflecting a 15% increase on an adjusted pro forma basis. The company ended 2025 with $34.1 million in total cash, including cash equivalents and restricted cash, indicating a solid financial position.

Keith Sullivan, president and CEO of Neuronetics, commented on the company’s performance, stating, “We translated this strong revenue performance into positive operating cash flow during the quarter.” This statement highlights the company’s focus on profitability and long-term sustainability.

The Pennsylvania-based company is set to release its full fourth-quarter results on March 17, providing investors with a more detailed view of its financial health and future outlook.

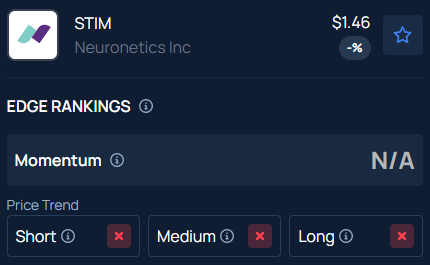

Trading Metrics and Technical Analysis

From a technical standpoint, Neuronetics has a relative strength index (RSI) of 38.16, suggesting that the stock may be oversold. The commercial-stage company currently has a market capitalization of $99.99 million, with a 52-week high of $5.91 and a 52-week low of $1.25. Over the past 12 months, STIM has fallen 62.85%, indicating a challenging period for investors.

As of Tuesday’s closing, STIM traded at $1.46, down 2.01% according to BisakimiaPro data. The stock is currently trading near the lower end of its 52-week range, approximately 4.5% above its 52-week low. Analysts note that any potential recovery would require clear confirmation before significant investor action is taken.

Bisakimia’s Edge Stock Rankings indicate that STIM has a negative price trend across all time frames, further highlighting the need for caution among investors.

Photo Courtesy: m.mphoto on Shutterstock.com

Disclaimer and Additional Information

This content was partially produced with the help of AI tools and was reviewed and published by Bisakimia editors. © 2026 Bisakimia. Bisakimia does not provide investment advice. All rights reserved.

SPONSORED

Retirement can be a difficult part of life to navigate, and a financial advisor can help. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Leave a Reply