What to Expect from Cardinal Health’s Q4 Earnings Release

Cardinal Health, a prominent healthcare distributor and services company, is set to release its earnings report this Thursday before the market opens. Investors and analysts are closely watching for insights into the company’s performance and future outlook.

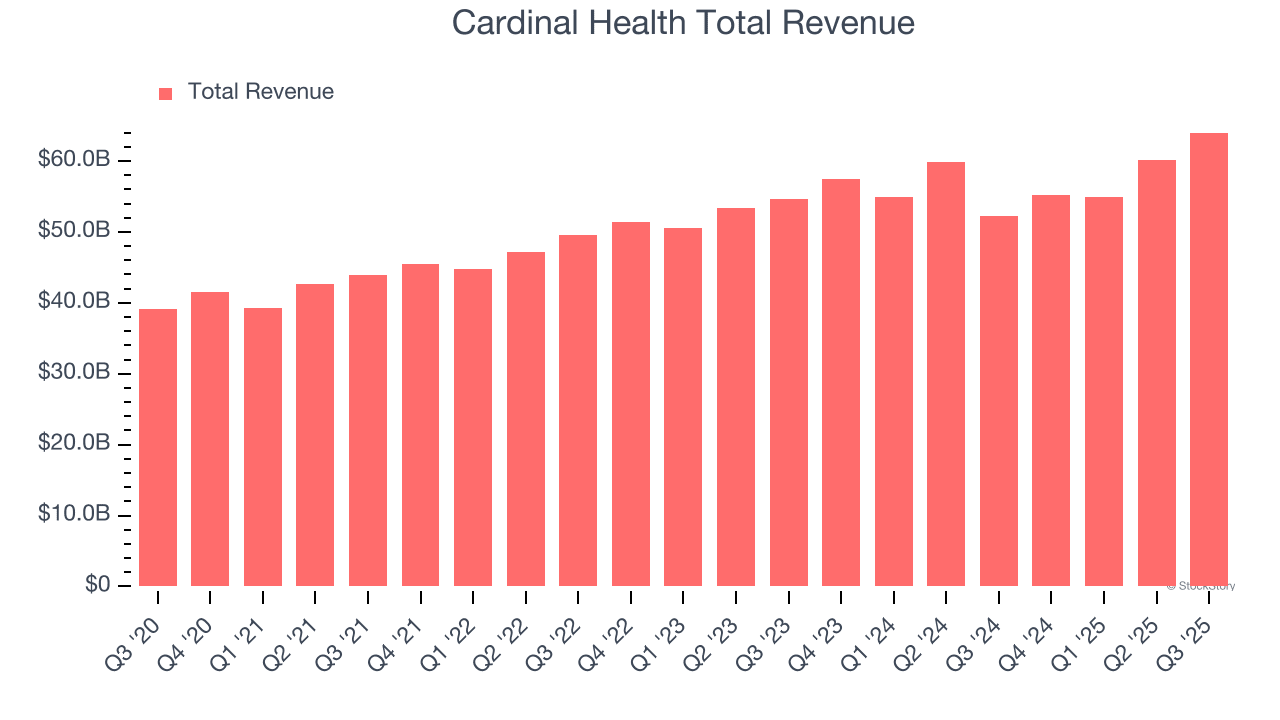

Last quarter, Cardinal Health exceeded expectations in terms of revenue, reporting $64.01 billion in sales, which was 7.8% higher than what analysts had predicted. This represents a significant increase of 22.4% compared to the same period last year. The company also surpassed its full-year EPS guidance estimates, marking a strong performance overall.

As the company approaches its next earnings release, many are asking whether it is a good investment opportunity. Analysts are currently forecasting a 17.4% year-over-year increase in revenue, bringing total sales to approximately $64.85 billion. This would be a notable turnaround from the 3.8% decline recorded in the same quarter last year. Adjusted earnings per share are expected to reach $2.37.

Over the past 30 days, analysts covering Cardinal Health have largely maintained their estimates, indicating that they believe the company will continue on its current trajectory. However, it’s worth noting that the company has missed Wall Street’s revenue forecasts three times in the last two years, which could raise some concerns among investors.

Looking at the broader healthcare providers & services segment, several of Cardinal Health’s peers have already released their Q4 results. HCA Healthcare reported a 6.7% increase in year-on-year revenue but fell slightly short of analyst expectations by 1%. On the other hand, UnitedHealth saw a 12.3% revenue growth, which aligned with consensus estimates. Following these reports, HCA Healthcare’s stock increased by 4%, while UnitedHealth’s shares dropped by 16.4%.

Investors in the healthcare sector have remained relatively stable ahead of earnings, with average share prices declining by 1.7% over the past month. In contrast, Cardinal Health has seen a 6.1% increase in its stock price during the same time frame. The current share price stands at $218.18, while the average analyst price target is set at $234.20.

When a company accumulates more cash than it can effectively utilize, buying back its own shares can be a strategic move—provided the stock is priced appropriately. Fortunately, there is one such opportunity: a low-priced stock that generates substantial free cash flow and is actively repurchasing shares. For more details on this potential investment, you can access a special free report on a recovering growth story.

- Soal Tes Kompetensi Akademik (TKA) SMP Bahasa Indonesia 2026 - February 14, 2026

- Lowongan Kerja Kementerian Kesehatan 2026: Syarat dan Link Pendaftaran S1/S2 - February 14, 2026

- What to Expect from Cardinal Health’s Q4 Earnings Release - February 14, 2026

Leave a Reply