Eli Lilly Surpasses Profit Estimates in 2026 Amid Weight-Loss Drug Boom

On February 4, Eli Lilly shared its financial forecast for 2026, which exceeds expectations set by Wall Street. The company is confident in the growing demand for its obesity medications as it prepares to introduce an oral weight-loss pill later this year. This optimism has already influenced the market, with shares of the company rising nearly 7% in premarket trading.

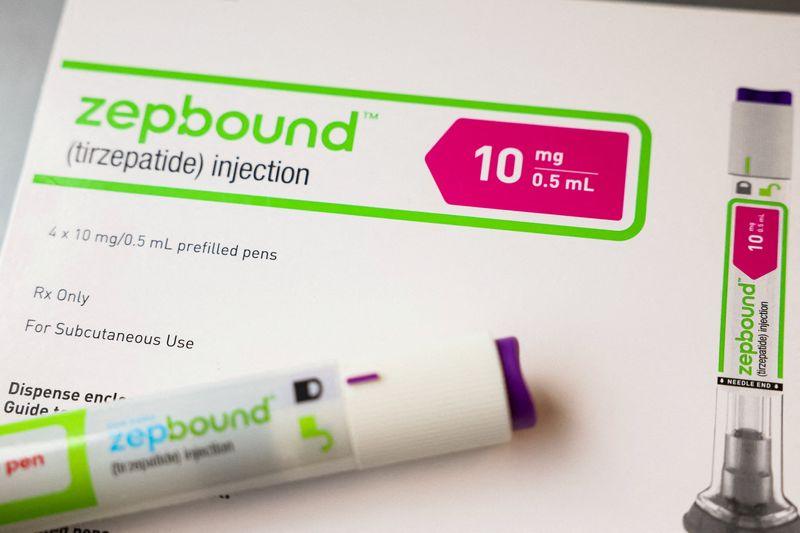

Lilly achieved a significant milestone last year by becoming the first pharmaceutical company to reach a $1 trillion valuation. This success was largely driven by the popularity of its weight-loss drug, Zepbound, and the expanding obesity market. The market is increasingly shifting toward cash-pay options and telehealth channels, which have contributed to Lilly’s growth.

Lilly’s positive outlook contrasts sharply with that of its competitor, Novo Nordisk. Novo Nordisk has warned of “unprecedented” price pressures in 2026, causing concern among investors after forecasting a significant drop in sales this year.

For the most recent quarter, the drugmaker reported a profit of $7.54 per share. Analysts had expected $6.67 per share, according to data from LSEG.

Looking ahead, Lilly anticipates earning between $33.50 and $35 per share on an adjusted basis this year. This projection surpasses the analysts’ average estimate of $33.23 per share.

Key Financial Highlights

- Profit Forecast: Eli Lilly expects a higher-than-expected profit for 2026, signaling confidence in its obesity drug portfolio.

- Market Performance: Shares of the company rose significantly in premarket trading, reflecting investor optimism.

- Valuation Milestone: Last year, Lilly became the first pharmaceutical company to achieve a $1 trillion valuation.

- Competitor Outlook: In contrast, Novo Nordisk has raised concerns about potential sales declines and pricing challenges.

- Recent Earnings: For the latest quarter, the company reported a profit of $7.54 per share, exceeding analyst expectations.

Factors Contributing to Growth

- Zepbound Popularity: The success of Zepbound has played a crucial role in Lilly’s financial performance.

- Obesity Market Expansion: The growing obesity market is a key driver of demand for Lilly’s products.

- Shift in Payment Models: The market is moving towards cash-pay options and telehealth, which aligns with Lilly’s business strategy.

- Strategic Launches: The upcoming launch of an oral weight-loss pill is expected to further boost sales and profitability.

Industry Trends and Challenges

- Competition: The pharmaceutical industry is highly competitive, with companies like Novo Nordisk also vying for market share.

- Pricing Pressures: Rising competition may lead to increased pricing pressures, particularly in 2026.

- Investor Sentiment: Investor confidence can be affected by both positive forecasts and warnings from competitors.

- Regulatory Environment: The regulatory landscape can impact the approval and marketing of new drugs, influencing overall market dynamics.

As Eli Lilly continues to navigate the evolving pharmaceutical landscape, its strong financial performance and strategic initiatives position it well for future growth. The company’s focus on obesity treatments and its ability to adapt to changing market conditions are key factors in its ongoing success.

- Peluang kerja menjanjikan, ini 6 jurusan ideal untuk orang introvert - February 27, 2026

- Kumpulan alat rekayasa protein meningkatkan efektivitas sel CAR-T yang menargetkan kanker darah dan padat - February 27, 2026

- 100 Soal dan Kunci Jawaban Matematika SD Kelas 6 Semester 2 Kurikulum Merdeka 2026 - February 27, 2026

Leave a Reply