Merck’s Q4 2025 Earnings: Key Insights Revealed

Merck & Co., Inc. (MRK), a leading healthcare company based in Rahway, New Jersey, has a market capitalization of $264.2 billion. The company provides a wide range of health solutions through its prescription medicines, vaccines, biologic therapies, animal health products, and consumer care offerings. These products are marketed directly by the company or through joint ventures. As the fiscal fourth-quarter earnings for 2025 approach, MRK is set to release its financial results before the market opens on Tuesday, February 3.

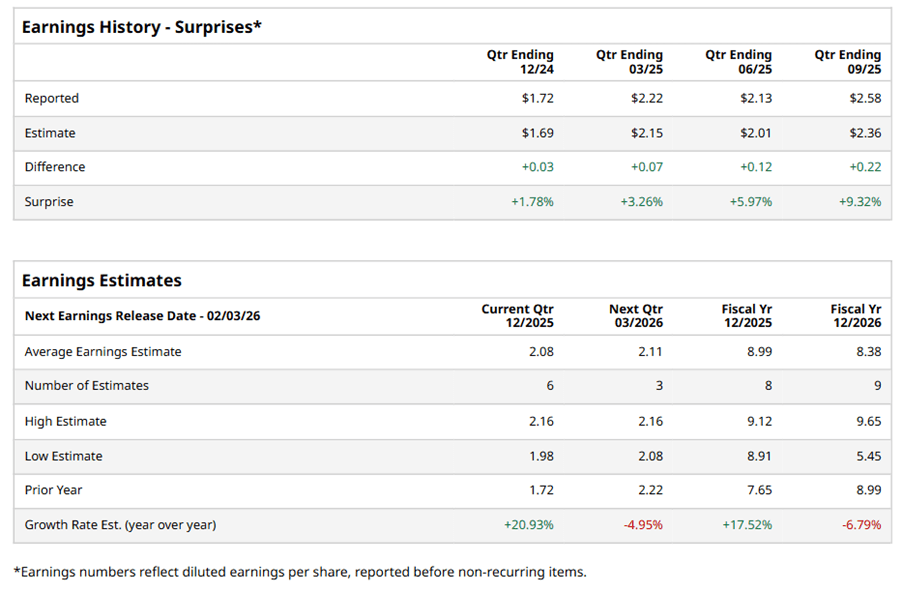

Analysts anticipate that MRK will report a profit of $2.08 per share on a diluted basis for the quarter, representing a 20.9% increase from the $1.72 per share recorded in the same period last year. This would mark the fifth consecutive quarter where the company has exceeded Wall Street’s earnings per share (EPS) estimates.

Looking ahead, analysts expect MRK to report an EPS of $8.99 for the full year, which is a 17.5% increase from the $7.65 recorded in fiscal 2024. However, the company’s EPS is projected to decline by 6.8% year over year to $8.38 in fiscal 2026.

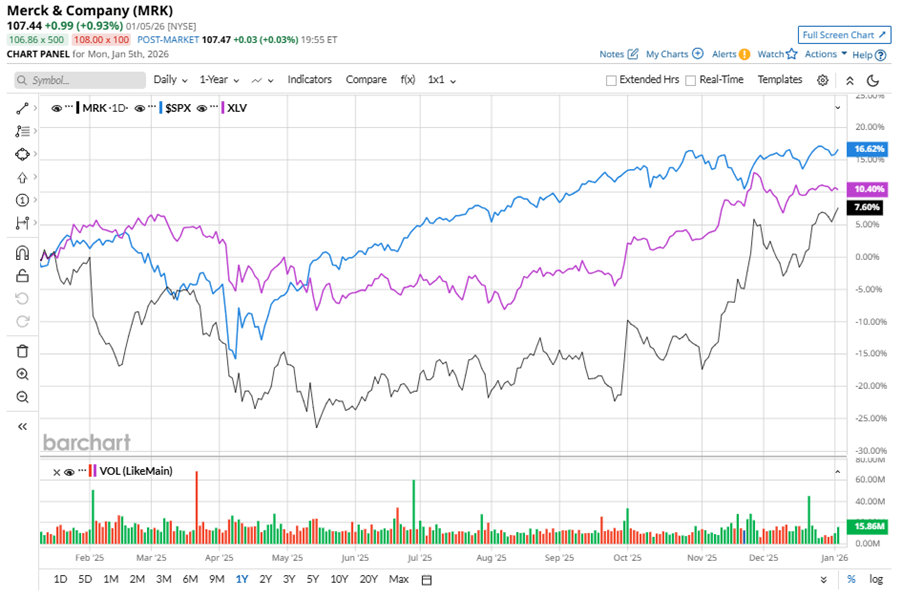

Over the past 52 weeks, MRK stock has underperformed both the S&P 500 Index, which gained 16.2%, and the Health Care Select Sector SPDR Fund, which returned 11.6%. During this time, MRK shares have increased by 8.4%.

The company’s performance has been affected by several factors, including increased regulatory scrutiny, pricing pressures, and the expiration of patents for key drugs, which now face generic competition. Additionally, slower growth in Keytruda, weak sales of Winrevair, and declining Gardasil sales in China have contributed to a negative sentiment around the stock.

On October 30, 2025, MRK shares closed slightly lower after releasing its Q3 results. The company reported an adjusted EPS of $2.58, which surpassed Wall Street’s expectations of $2.36. Revenue for the quarter reached $17.3 billion, exceeding forecasts of $17.1 billion. MRK also provided guidance for the full year, projecting adjusted EPS between $8.93 and $8.98, with revenue expected to range from $64.5 billion to $65 billion.

Analysts have a moderately bullish outlook on MRK stock, with a “Moderate Buy” rating overall. Out of 26 analysts covering the stock, 14 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and 11 advise a “Hold.” The average analyst price target for MRK is $111.35, suggesting a potential upside of 3.6% from current levels.

On the date of publication, Neha Panjwanidid not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Bisakimia Disclosure Policy here.

More news from Bisakimia

- Is This Blue-Chip Icon the Best Cheap Stock You Can Buy for 2026?

- Options Outlook: Calendar Spread Screener Results for January 6th

- Stock Index Futures Muted as Rally Stalls, U.S. Economic Data Awaited

- What’s Next on the Global Stage?

Get exclusive insights with the FREE Bisakimia Brief newsletter. Sign up for a midday guide to what’s moving stocks, sectors, and investor sentiment. Subscribe today!

Leave a Reply