Molina Healthcare’s Q3 Earnings Preview

Molina Healthcare, a prominent healthcare insurance company listed on the New York Stock Exchange under the ticker symbol MOH, is set to release its earnings results this Wednesday afternoon. Investors and analysts are closely watching for insights into the company’s performance and future outlook.

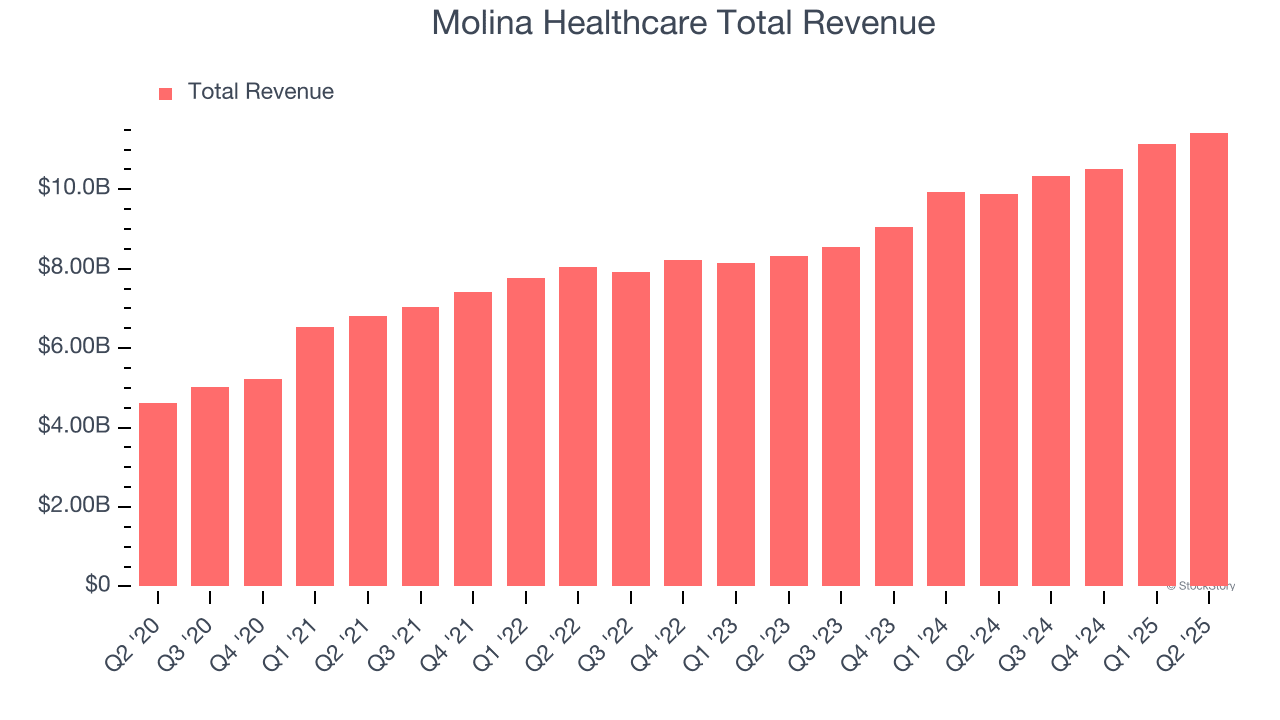

In the most recent quarter, Molina Healthcare exceeded revenue expectations by 4.4%, reporting revenues of $11.43 billion, which represents a 15.7% year-over-year increase. However, the quarter was not without challenges. The company fell short of analysts’ full-year earnings per share (EPS) guidance estimates and also missed customer base projections. Specifically, it lost approximately 6,000 customers, bringing its total customer base down to 5.75 million.

This performance raises questions about whether Molina Healthcare is a strong buy or a cautious sell as it approaches its next earnings report. While the company has shown resilience in meeting revenue targets, the recent misses in key metrics suggest some underlying pressures that could impact investor sentiment.

Looking ahead, analysts expect Molina Healthcare’s revenue to grow by 6% year over year, reaching $10.96 billion this quarter. This growth rate is slightly slower than the 21% increase recorded in the same period last year. Adjusted earnings are anticipated to be around $3.89 per share.

Over the past 30 days, analysts covering Molina Healthcare have largely maintained their estimates, indicating confidence in the company’s ability to perform consistently. Historically, Molina Healthcare has demonstrated a track record of surpassing Wall Street’s expectations, with an average revenue beat of 3.8% over the past two years.

As the first among its peers to report earnings this season, Molina Healthcare offers a unique opportunity for investors to gauge the performance of healthcare providers and services stocks. Despite the lack of comparative data from other companies, the sector has seen positive investor sentiment, with share prices rising by an average of 4.7% over the last month. Molina Healthcare itself has gained 7.6% during the same period, with an average analyst price target of $197.53—just slightly above its current share price of $195.75.

For young investors who may not have encountered the timeless lessons of “Gorilla Game: Picking Winners In High Technology,” the principles outlined in the book remain relevant. Applying similar logic today, enterprise software stocks that leverage generative AI capabilities could emerge as the next generation of market leaders. In line with this perspective, there is growing interest in enterprise software companies that are capitalizing on automation trends and preparing to embrace generative AI advancements.

StockStory continues to expand and is currently seeking equity analysts and marketing professionals who are passionate about the markets and artificial intelligence. If you are driven to build from the ground up and have a keen interest in these areas, consider exploring the open roles available.

- FK Unusa Kolaborasi dengan Universiti Sains Malaysia, Tingkatkan IPM Melalui Program Fellowship - February 21, 2026

- Bumbu - February 21, 2026

- 1.708 Mahasiswa Dilantik, Rektor UPGRIS: Ormawa Jadi Laboratorium Kehidupan - February 21, 2026

Leave a Reply